August 2021 – MMGY Travel Intelligence is the exclusive social listening provider for the U.S. Travel Association’s Travel Recovery Insights Dashboard. Social listening is a vital tool in helping to inform recovery and tapping directly into how consumers are talking about travel across a range of areas.

MMGY Global social teams are experts at identifying and understanding the social voice of the traveler landscape – and how to use it to inform the way forward for our travel and hospitality partners. Within this report are key recovery indicators identified through social listening for the month of August 2021.

5 POINTS TO KNOW ABOUT TRAVEL RECOVERY THIS MONTH

- A Return to 2019 Levels. Social travel mentions saw a return to 2019 levels as August 2021 mentions saw a 3% increase over August 2019.

- Working for the Getaway. Continued to see a significant amount of chatter focused on people talking about working to enable their vacation.

- Positive Booking Sentiment. August 2021 registered a very positive 83% net sentiment for those talking across social media about booking travel.

- Fear of Cancellation. Late summer challenges tied to canceled flights drove down sentiment tied to air travel, registering a paltry 22% net sentiment.

- Celebrating with a Trip. Life moment travel continues to see a steady return to normal levels helped by people planning travel to celebrate their birthday.

HOW ARE GENERAL TRAVEL CONVERSATIONS PACING?

All Travel Mentions – August 2021 (MoM Comparison)

- Travel-related social mentions decreased slightly by 4% in August 2021 compared to July 2021. As the summer travel season kicked off, June led all summer months with 1.17 million mentions across social media.

- August 2021 mentions registered a 16% increase in mentions over August 2020 and a nearly 3% increase over August 2019 in total travel mentions.

- Total engagements for August 2021 jumped by 17% compared to July 2021. June 2021 had the highest total engagements through summer, with nearly 13.5 million recorded during the month.

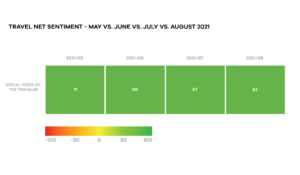

Summer Sentiment – June / July / August 2021

- Summer travel sentiment peaked in June 2021 with 69% average net sentiment.

- Travel sentiment dropped in August 2021 by 5 points driven by fears associated with the impact of Delta on the travel landscape.

- Travel sentiment peaked this year in May 2021, registering a 71% sentiment score.

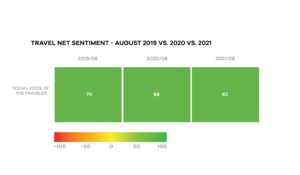

Monthly Travel Sentiment – 2019 vs. 2020 vs. 2021

- While overall travel volume for August 2021 was extremely high, net sentiment levels underperformed compared to 2019 and 2020.

- Historically, August performs closer to 70 as registered in 2019.

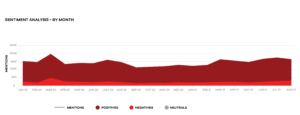

Sentiment Analysis by Month

- Positive travel mentions in August 2021 (133K mentions) dipped slightly from July 2021 (146K mentions)

- July 2021 positive travel mentions were the highest recorded in the past 18 months.

- Negative mentions did increase by 6% from July 2021 to August 2021.

WHAT IS DRIVING TRAVEL CONVERSATIONS?

Top Terms and Sentiment Attributes

- Travel conversations were dominated by people talking about either being on vacation or returning from a vacation.

- Work-related mentions were mostly tied to people either talking about returning to work from vacation or working to afford another vacation.

- Negative mentions around canceled travel were mostly centered around flight cancellations and altering travel plans based on a rise in Coronavirus delta variant cases within specific areas.

HOW IS TRAVEL PACING (INTENT/CONSIDERATION/BOOKING)?

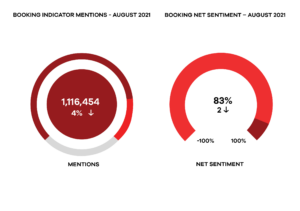

Travel Booking Indicators – August (MoM Comparison)

- Travel booking indicators dipped only slightly with a 4% decrease from July 2021 to August 2021 in total mentions

- Net sentiment remained strong for August 2021 to finish at 83%

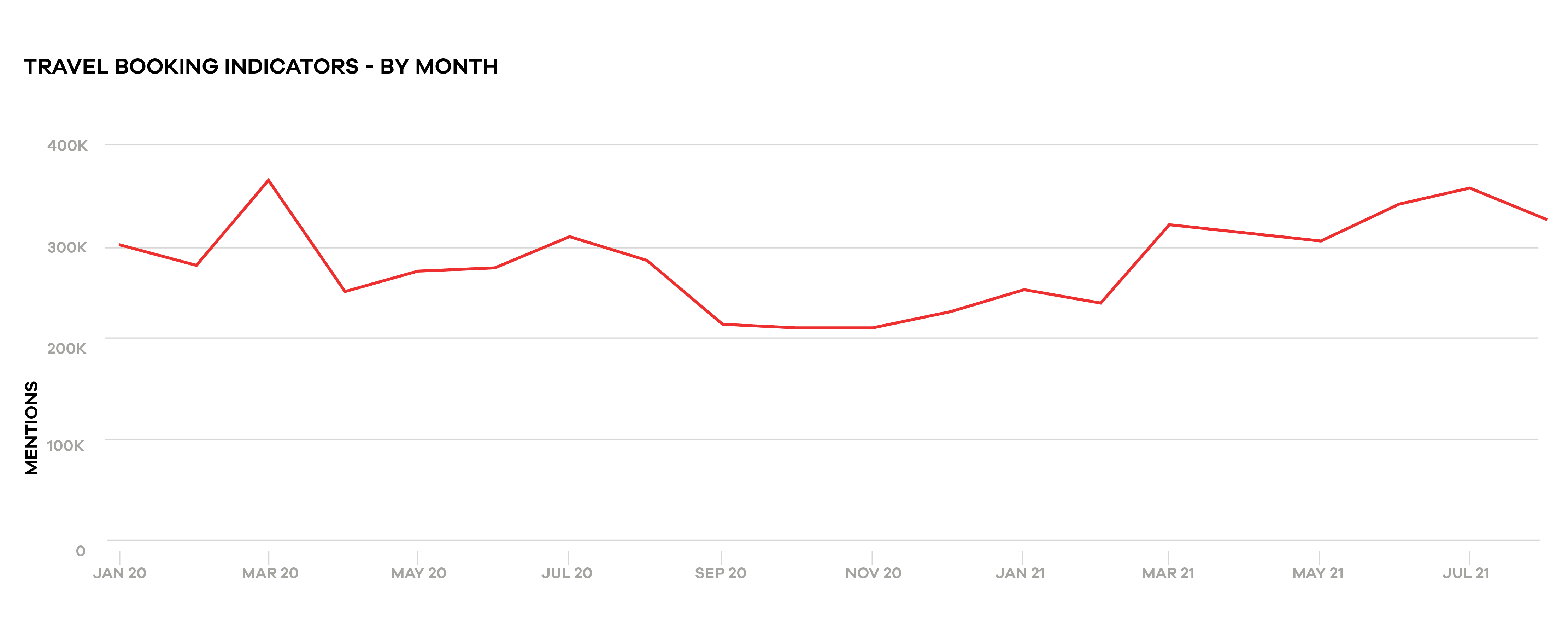

Travel Booking Indicators – By Month

- Travel booking indicator mentions peaked during the summer, with July 2021 being the top month in the past year with 356,900 total mentions.

- August 2021 saw a significant jump over August 2020 with a 14% increase resulting in 326K mentions.

WHAT ARE SOME KEY AREAS OF INTEREST FOR TRAVEL?

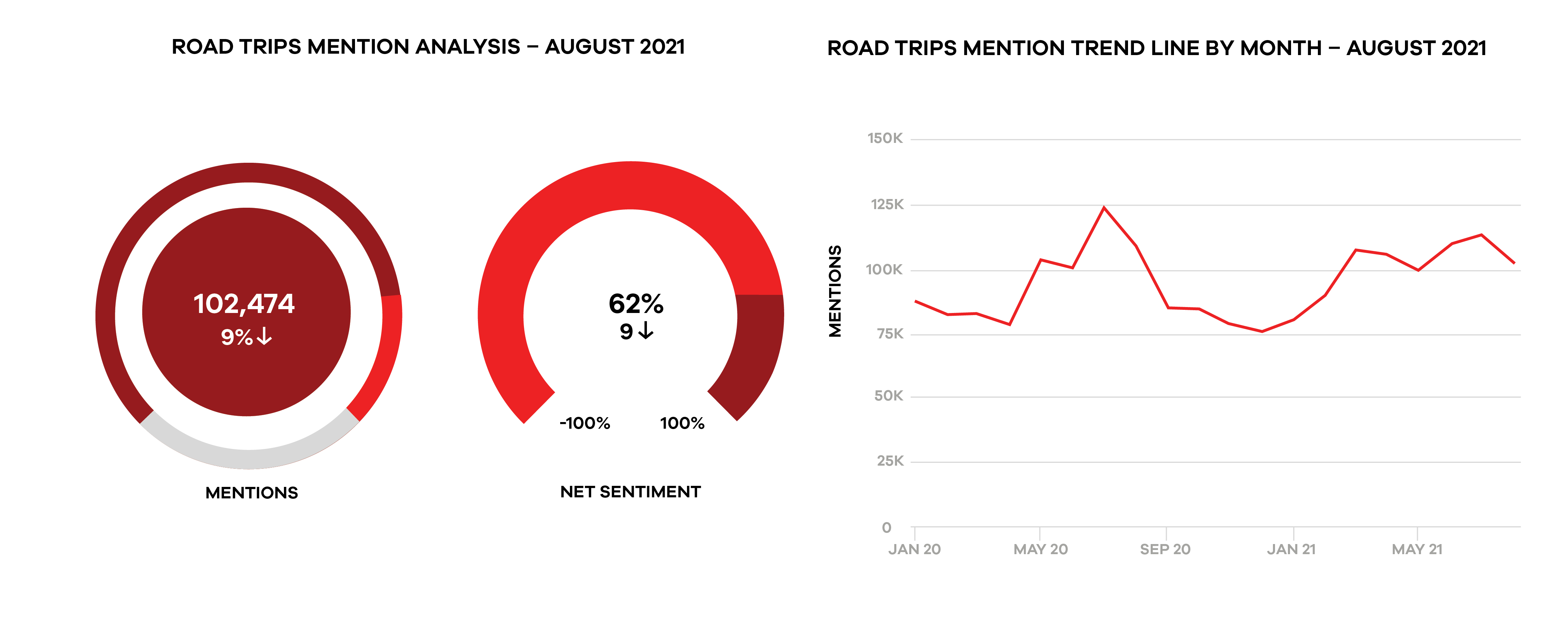

Road Trips Mention Analysis

- Travel mentions tied to road trips remained strong this summer.

- Mentions dipped by 9% from July 2021 to August 2021, which is expected as the busy summer travel season slows through the end of August.

- Road trip mentions were down from August 2020 to August 2021 by 6% as travelers returned in part to air travel this summer.

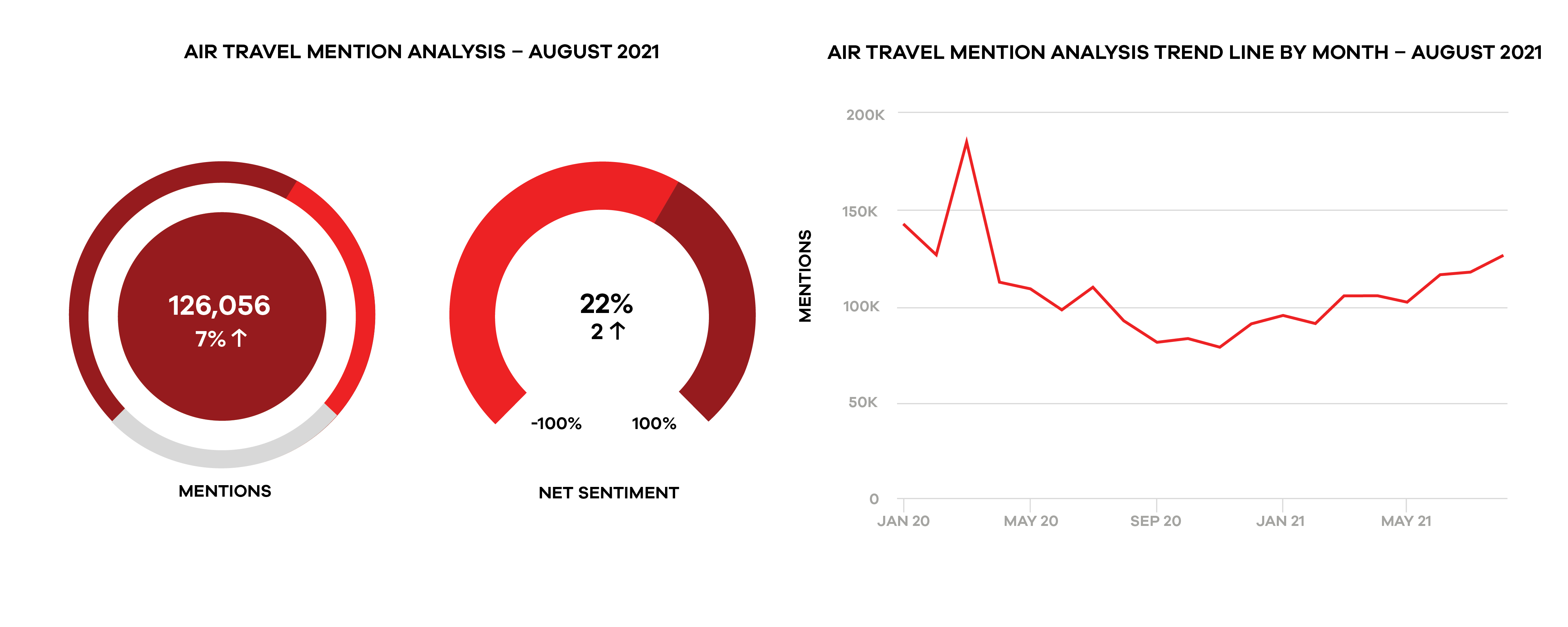

Air Travel Mention Analysis

- Mentions across air travel increased by 7% from July 2021 to August 2021.

- While air travel has seen a significant increase, flight cancellations are bringing down the overall net sentiment score to an extremely low 22%.

- The 126,056 total mentions is the highest total for air travel since the onset of the pandemic.

Accommodation Mentions (Hotels, Resorts, Airbnb, VRBO)

- Travel mentions tied to staying at overnight accommodations dipped by 4% from July 2021 to August 2021.

- Spring overnight stays outpaced summer mentions, which is usually not the case, showing the demand as the world started to reopen and travel rebounded.

- Overnight mentions comparing August 2020 to August 2021 registered a nearly 23% improvement.

HOW DOES TRAVEL SEASONALITY AND LIFE MOMENTS IMPACT LISTENING?

Summer Travel

- General summer travel mentions across social media remained flat, with only a 1% dip from July 2021 to August 2021.

- Summer travel mentions spiked in June 2021 with 72,865 mentions. This is a nearly 50% improvement comparing year-over-year numbers for June 2020 to June 2021.

Life’s Moments Travel – Anniversaries, Birthdays, Weddings

-

Birthday social mentions continue to lead all life moments associated with travel–remaining consistent since early March 2021 as more travel reopens.

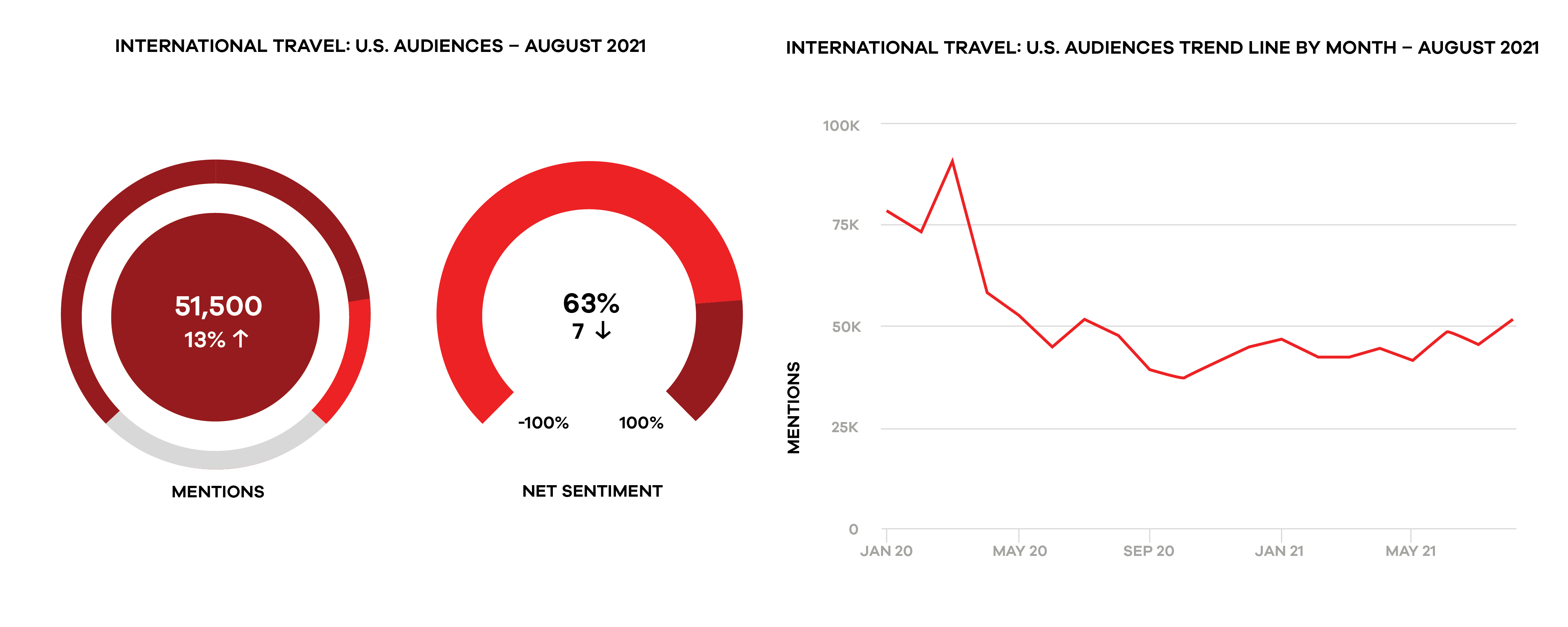

International Travel: U.S. Audiences

- Mentions around international travel for August 2021 (51,502) across U.S. audiences saw the highest one-month total since July 2020 (51,581).

- August 2021 generated a 13% increase over July 2021 in total international travel mentions across U.S. audiences.

- Conversation mentions for international travel are generally positive, with a 63% net sentiment rating.

- Mentions are focused on people actively traveling in approved international destinations (Mexico, Europe, etc.) or looking to plan as soon as travel continues to return.

About MMGY Travel Intelligence

MMGY Travel Intelligence is MMGY Global’s industry research and insights brand, offering proprietary data and research designed to power travel industry decision-makers through consumer insights, travel performance data, and audience modeling and segmentation. With offerings including DK Shifflet, the Portrait of American Travelers® and travelhorizonsTM as well as the recently launched groundbreaking “The Black Traveler: Insights, Opportunities and Priorities” report and inaugural Portrait of European Travellers® study, MMGY Travel Intelligence features top consumer insights exclusively for the travel and tourism industry. To learn more about the extensive collection of research, analytics and strategy services, visit mmgyintel.com or email us at research@mmgyglobal.com.

About MMGY Global: Business Strategy Practice

MMGY Global business strategy team members go where others don’t. They go where the data leads them to provide critical insights and strategic guidance that maximize contributions from every channel, team member and agency partner. Through tools like Portrait of American Travelers®, Terminal and social listening, they help turn these insights into actions to create meaningful and fully integrated recovery plans for our clients.

About MMGY Global: Social Listening Practice

MMGY Global is the exclusive social listening provider for the U.S. Travel Association’s Travel Recovery Insights Dashboard. MMGY Global social team members have been using social listening for the past 10 years. Our social teams identify key observations and insights gleaned through social listening to set a strong data-driven foundation as a key pillar in developing a successful social media strategy for our clients around the world. Learn more about MMGY Global’s social marketing practice.