As travel brands have waded through the murky waters of recovery this year, most have turned their marketing attention toward domestic drive-market and short-haul flights, especially in the U.S. While this approach is logical and presenting short-term results in this fiscal year, there will be a detrimental long-term impact to those who do not re-engage international audiences quickly.

Demand for International Travel is Strong

We know from our Portrait of American Travelers data that demand for U.S. outbound travel has remained strong throughout the pandemic. Since Q2 of last year, intent to travel internationally has hovered around 20%, just four points below pre-pandemic levels. We see similar demand in Europe, as well. A recent study conducted by the ETC suggests that 56% of Europeans intend to travel by the end of August with only a third of those travelers focused on domestic trips.

Travel corridors will open between the U.K, Europe and the U.S. this summer. In April, the European Commission announced that international travelers with proof of vaccination will be welcomed into European countries as early as this summer. And while the UK’s new international travel policy only includes a limited number of “green” markets (where visitors are welcomed without quarantine or isolation requirements), it is only time before the U.S. and a greater number of EU countries are included.

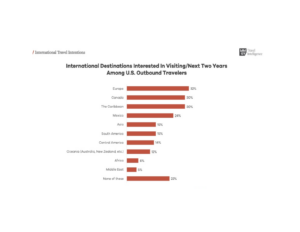

Our research points to the European region as the top international destination of interest for leisure travelers in the U.S., even more than Mexico and the Caribbean.

The question is not if international travel will resume, but how quickly – and we believe it’s coming sooner and faster than the industry expects.

International Travel Planning and Booking Has Already Begun

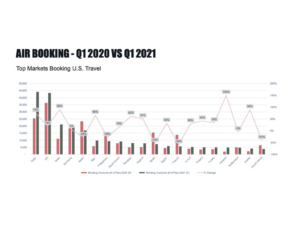

According to data provided by Travelport, international air bookings have already commenced. As an example, U.S. outbound travelers have already started making plans for some of Europe’s most popular markets. Q1 bookings from the U.S. to Greece are up by 278% and are up 187% to Italy compared to Q1 2020. Similarly, markets abroad like India and the UK have shown higher booking rates to the US vs. early 2020.

The increase in international bookings points, in part, to an immediate opportunity for travel brands to re-enter the long-haul market. Unlike previous travel industry downturns, the challenges facing destinations and travel providers today are not based on financial concerns, but rather perceptions of safety and accessibility. This is demonstrated by MMGY Travel Intelligence’s Travel Sentiment Index, which showcases how perceptions of affordability and availability of funds are outpacing previous marks.

The result is an immediate impact on short-term booking windows this year as leisure travelers look to get back in the air. Recent Travelport search data shows that U.S. travelers are currently looking for international travel options on an average of 73 days from the time of search. This is compared to over 90 days pre-pandemic. We see the same trend for international travelers searching for US destinations, which is averaging 72 days instead of 100+ days during normal conditions.

Travel Brands Who Do Not React Soon Will See Negative Long-Term Impacts

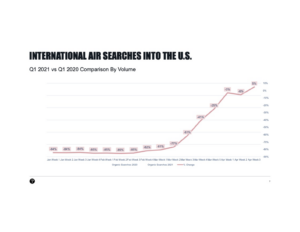

While it is important to monitor the short term impact on summer and early autumn travel, the more critical concern for long-haul destinations and travel providers should be in how they are engaging travelers now for leisure visits in 2022. With the recent announcements across the UK and Europe this month, flight searches to the US have risen substantially since Q1.

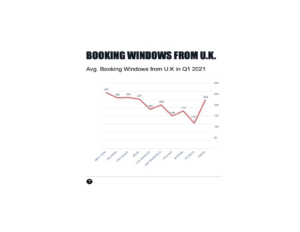

While this has increased confidence for short-term travel, it is also having a halo effect in some markets on long-term planning. In the UK, for instance the average booking window is now 143 days for flights booked to the US (compared to 120 days in 2020) and the latency for some popular cities like New York and Las Vegas are well over 200 days. This means that if destinations are not marketing to these travelers soon, they are going to miss the opportunity to impact Q1 2022.

Measurement, Flexibility and Optimization Will Be Key

As travel brands evaluate their marketing and distribution strategies through the end of the year, savvy marketers will consider the impact that today’s tactics will have on FY 2022 results. Expect to see an influx of investment into data centralization and measurement to create greater transparency, as well as nimble (primarily digital) platforms that allow marketers to optimize and shift as travel trends change.